FINANCIAL SERVICES

Make every digital interaction compliant, consistent, and conversion-ready

Trust is your currency. One outdated disclosure, inaccessible form, or broken application flow can damage that trust with customers, regulators, and the markets. Siteimprove.ai helps banks, insurers, and wealth managers govern their digital presence, reduce compliance risk, and understand how customers move from research to purchase, without relying on fragile third-party cookies.

Leading financial institutions trust Siteimprove with their digital experience.

What makes us the right fit?

Solutions for every financial services digital team

Financial services audiences expect seamless digital experiences—and regulators expect proof you’re in control. Siteimprove helps banks, insurers, and wealth firms understand what’s working, fix what’s broken, and keep high-stakes digital journeys compliant across sites, apps, and portals.

Marketing Leaders

Get a clear, defensible view of how digital is driving deposits, policies, and AUM—not just vanity metrics. See which journeys and products convert, where friction costs you revenue, and where to invest next while staying aligned with brand, legal, and compliance requirements.

Performance Marketers

Work around signal loss and strict data rules without guessing. Use privacy-safe analytics to understand which channels, campaigns, and keywords drive funded accounts, applications, and qualified leads—then optimize spend across search, paid, and email with confidence.

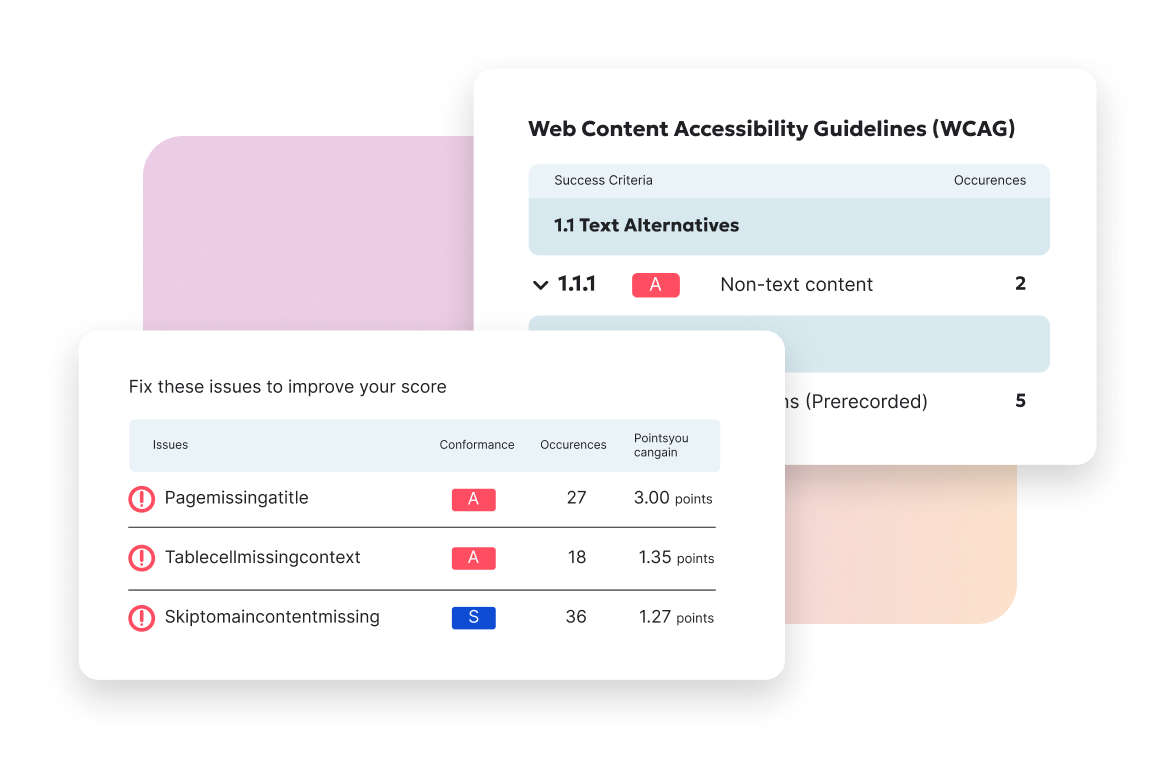

Accessibility Leaders

Treat accessibility like any other core compliance program. Identify WCAG issues across your public sites, logged-in portals, and product pages, prioritize high-risk customer journeys, and document remediation progress to satisfy regulators, auditors, and internal risk teams.

Building a trustworthy, well-governed digital foundation

"Before bringing on Siteimprove, I always had anxiety about the website. With the Quality Assurance tool, I’m now able to say with confidence that everything is up-to-date, nothing is broken, and everything is secure, which has been super helpful in gauging our success."

Michael Pellegrino

Website Content Administrator at

Valley Bank

Read the case studySee how Scotiabank, Community First Credit Union, and Qudos Bank use Agentic Content Intelligence - Siteimprove to improve their digital branches.

GUIDE

Deliver an engaging, compliant financial services website with Siteimprove

Learn how to make your digital branch as strong as your in-branch experience, while staying compliant and accessible across key journeys.

Download the full guide on building an engaging, compliant financial services website

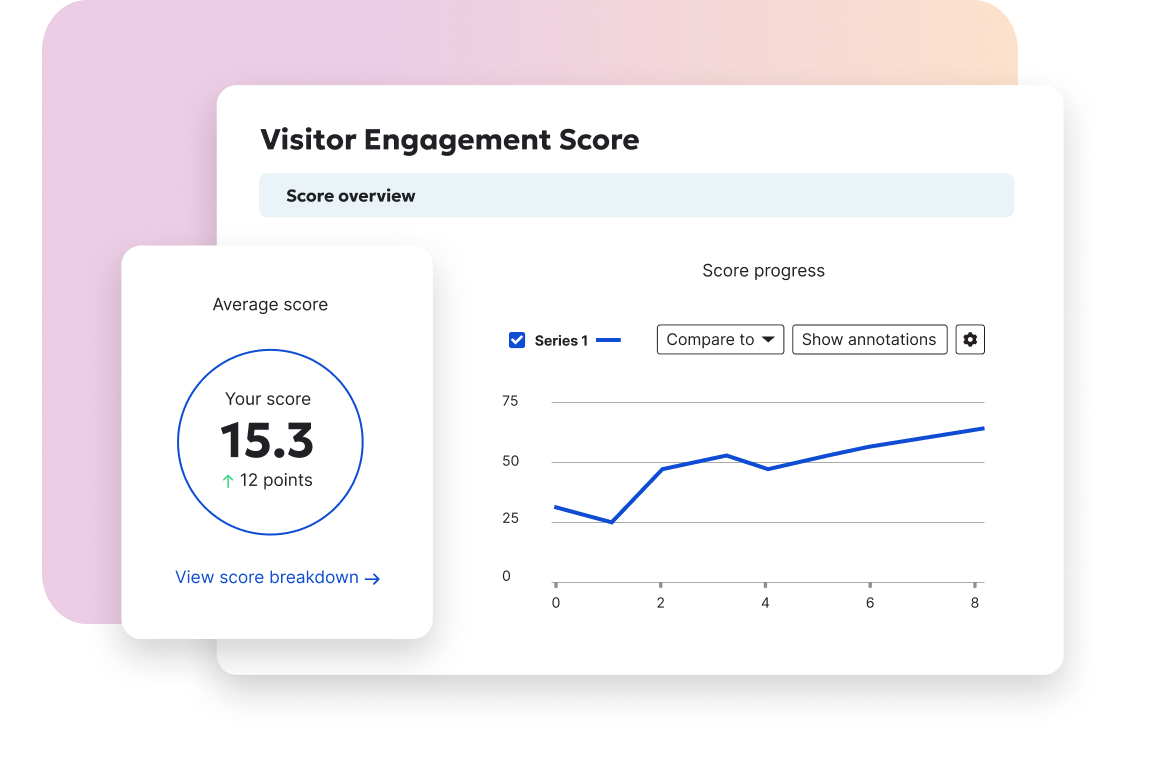

Find friction in high-value journeys before your customers do

A unified platform for your entire team

Content transparency

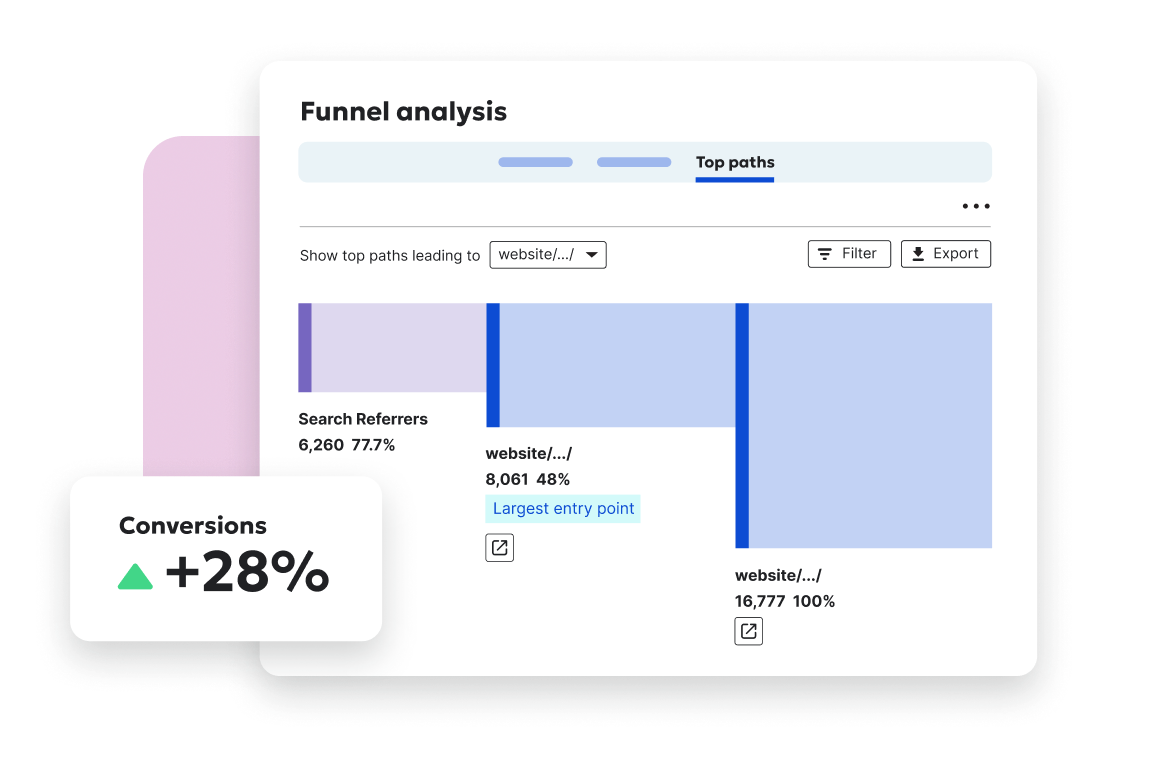

How can you know precisely what content drives the most conversions? Enter our Top Paths feature, designed to show your team which items move visitors further down the funnel so they can ditch what doesn't convert and double down on what does. Budget ownders, rejoice: Proof at last that most content doesn't necessarily mean more ROI.

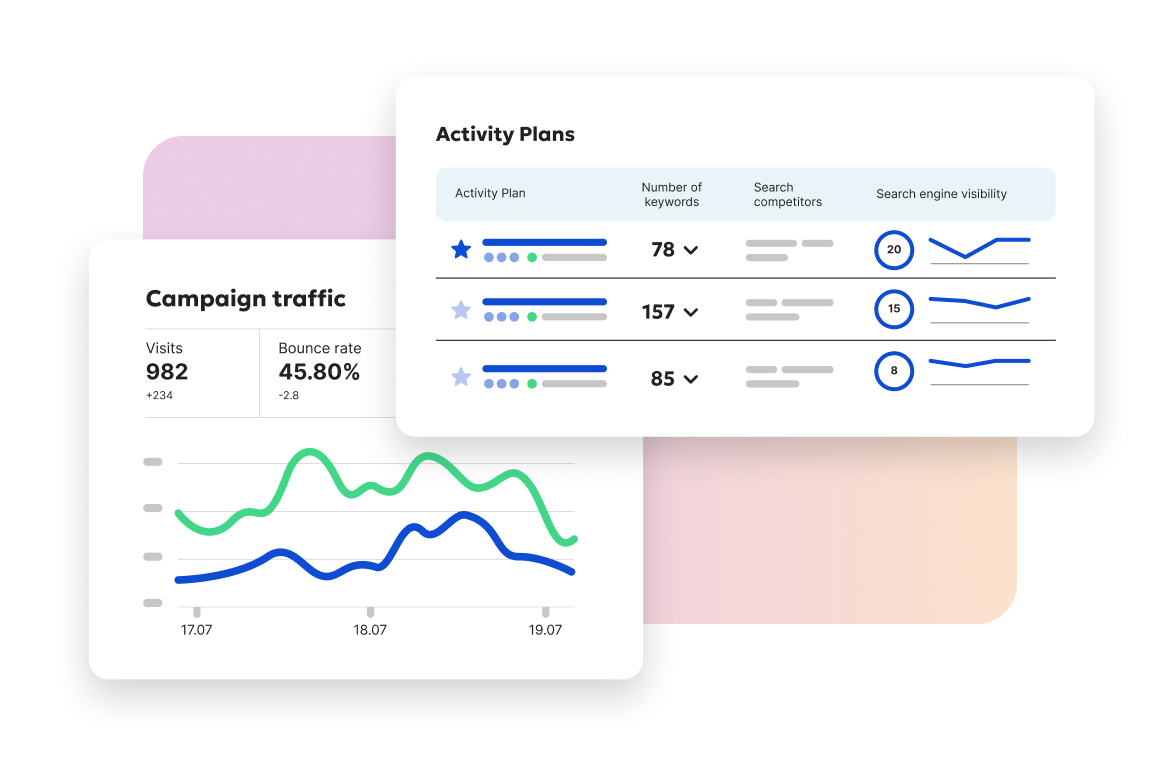

SEO strategy

Go beyond basic rank tracking. Our platform provides the deep competitive intelligence and performance data you need to uncover hidden opportunities, report on the impact of your SEO efforts, and protect your organic traffic.

Paid ads made simple

Stop wasting your budget on underperforming campaigns. Siteimprove provides the deep analysis you need to optimize your Quality Score, improve landing page effectiveness, and make smarter decisions that increase conversions and lower your cost-per-acquisition.

Accessibility compliance

Get a real-time view of your organization's accessibility posture across every site and brand. Prioritize issues by business risk, track progress against internal policies and external regulations, and report improvements in a way that legal, compliance, and executives will actually trust.

Siteimprove solutions for financial services FAQs

Siteimprove.ai helps banks, insurers, credit unions, and wealth managers reduce digital compliance and reputational risk while improving the performance of their websites and campaigns. You get continuous visibility into site health, accessibility, and content accuracy, plus analytics that show how visitors move from initial research through to applications and account actions.

Siteimprove.ai continuously scans your websites and digital content to flag issues that could create compliance risk—such as accessibility violations, broken links, inconsistent disclosures, or out-of-date product information. This gives compliance and legal teams a defensible audit trail and a clearer picture of your digital estate, and helps you align with accessibility and communication standards in your markets.

Yes. Siteimprove.ai’s analytics and Top Paths view show you how visitors move between pages, content types, and key steps like calculators, comparison tools, and application forms. You can see where prospects engage, where they stall, and which journeys lead to the most valuable outcomes—so you can focus optimization efforts where they matter most.

Siteimprove.ai is designed to work within the strict privacy and security requirements of regulated industries. The platform uses privacy-conscious data collection and gives you visibility into on-site behavior without relying on invasive tracking. Your teams get the insight they need to improve experiences and performance while respecting customer privacy and working alongside your existing security controls.

Siteimprove.ai is often used jointly by digital marketing, web, UX, and compliance teams. Marketers use it to optimize campaigns and journeys, web and UX teams use it to manage site health and accessibility, and compliance and risk teams use reports and dashboards to monitor digital compliance and support audits.